January 2, 2025

Dear Sustainable Equity Strategy Clients and Friends:

Last year was a buoyant year for equities, stronger than expected on top of 2023’s exceptional returns. The U.S. economy was the “envy of the world,” quashing recessionary fears on the way to registering nearly 3% GDP growth.1 The Fed surprised with a jumbo rate cut in September that boosted small business confidence and broadened the equity market after a Magnificent 7 / AI-dominated first half of the year.2 Capital markets were wide open as thin spreads enticed companies into record debt issuance to finance their growth runways.3 Unemployment ticked up but remained low, real wage growth persisted and consumer spending held up, though warning signs emerged as a rising 47% of Americans saw themselves living paycheck to paycheck.4 Inflation declined to pre-pandemic levels, though accumulated price increases made the affordability crisis a dominant propellant of Trump’s win in November.5 As the business community, and equity markets, celebrated Trump’s low-tax, deregulatory plans, they also expressed concern about how his tariff and immigration proposals might rekindle inflation, delay further rate cuts, disrupt supply chains for manufacturing inputs, goods and labor, and spark a trade war while straining our military alliances at a time of geopolitical strife. In sum, a hefty dose of uncertainty was piled onto an elevated equity market even as it muscled higher in expectation of further dynamism ahead...

Mixed-message macro backdrops like this reinforce the importance of constructing resilient all-weather portfolios from the bottom up, as we strive to do. We believe it also suggests the value of factoring in secular trends that unfold somewhat independently of macro drivers, and which other investors may be underestimating, or neglecting altogether. For example, climate change was evidently a non-issue in the U.S. election despite: 2024 being on track to be the hottest year in recorded history; one-third of the U.S. being in drought; an unprecedented 24 climate disasters with losses over $1 billion each; and California’s explosive Park Fire headlining a wildfire season that burned 8.8 million acres across the West.6 Ironically, and seemingly unbeknownst to almost every voter (and investor), two of the top election issues – immigration and food prices – were strongly exacerbated by climate change. Drought in Central America, as well as in an astonishing 76% of Mexico as of mid-year, impaired agricultural economies and boosted emigration to the U.S.7 Climate change-fueled drought and crop disease in Brazil, Spain and West Africa contributed to skyrocketing prices for coffee (50-year high), olive oil (record high) and cacao (record high) respectively, while climate-accelerated H5N1 avian flu spurred the culling of poultry flocks that spiked egg prices.8 Messing with Americans’ morning coffee may yet prove to be a potent wake-up call on climate, and yes, the pun is intended and apologized for. In the meantime, we’re awake and paying attention on your behalf.

We Expect that Sustainable Investing Will Continue to Thrive

Though Trump’s climate views were out of the campaign spotlight, his win has prompted questions about how they will affect the world’s progress on climate, as well as sustainable investing’s role in attracting and allocating the needed capital. Our short answer is this: the shape of climate action will be modified, and electoral considerations did prompt us to execute modest portfolio adjustments (see section below on turnover), but we also believe that compensatory mechanisms will kick in to sustain robust progress, and that authentic sustainable investing will continue to thrive. Let’s expand on these in reverse order.

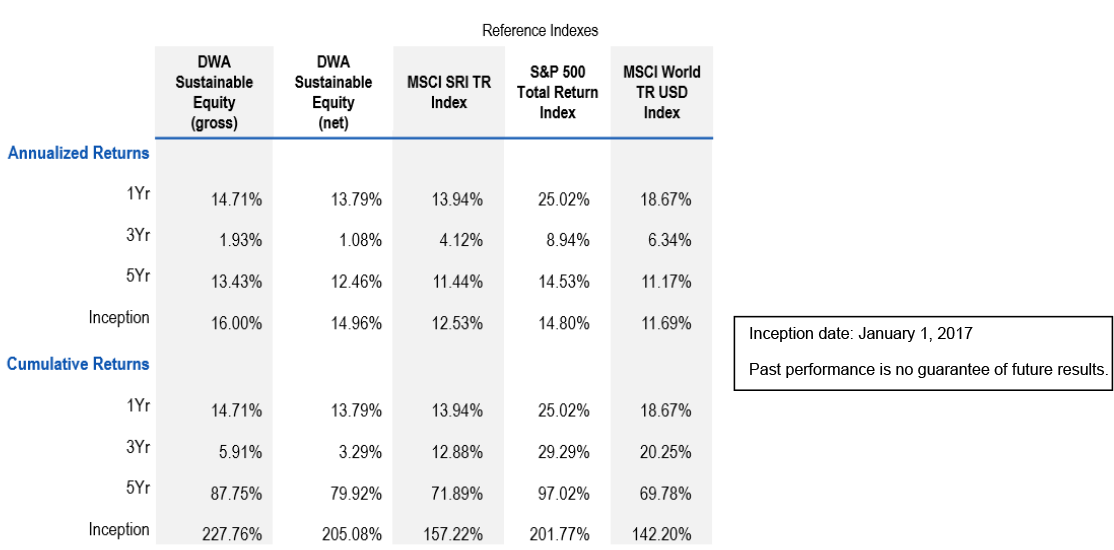

A core tenet of long-horizon fundamental investing is that all material risks and opportunities should be incorporated into one’s projection of cash flows, even if swings in sentiment (including electoral change) reflect temporary underappreciation of their significance. This is just rigorous fundamental investing with a wider analytical aperture. Climate change, water stress, agricultural degradation, deforestation, plastic pollution, and biodiversity loss are among those risks and opportunities that merit company-specific consideration, and if our attention to such factors becomes regarded as (even more) contrarian for a time, no problem. Indeed this may simply mean better buying opportunities for us on your behalf, while short-term traders and thematic opportunists rotate elsewhere. It’s perhaps timely to note here that we outperformed the S&P 500 by 880 basis points annualized in the first Trump term (24.8% to 16% gross), and though we can’t promise or expect a repeat, we believe that result speaks to our cautious avoidance of policy dependence when making investments. This year our Strategy returned 14.71% gross /13.79% net — bringing our 8-year track record to 16.00% gross / 14.96% net annualized and ahead of our reference indexes and 97% of 868 peer sustainability funds per the eVestment database (see full Performance Table on page 5).9

As for forward progress on the climate challenge itself, consider this: as concerning as the intensifying climate impacts are, they are also provoking an incredibly dynamic (and lucrative) drive to redesign and renovate the world across all sectors and geographies toward a more efficient, clean, electrified, regenerative, resource circular, and safer future – one that offers a higher, not lower, quality of life. Economic opportunity and job creation abound in this transition, and are well distributed across red, blue and purple districts of the country, making full repeal of Biden’s climate incentives anything but certain.10 The transition is happening globally and constitutes one of the greatest investment opportunities of our generation, or any generation. And as we elaborated in our 2nd Quarter letter (viewable here), it is fueled not only by policy ― which occasionally regresses ― but by accelerating technology innovation and rising consumer demand for solutions to the climate impacts they’re increasingly experiencing first-hand.11 Indeed, our conviction is that technology and consumer demand operate on their own logic and timeline and, if anything, may even be compensatorily accelerated by the withdrawal or pausing of policy support. The motivational thesis goes something like this: “Hey, if the government won’t solve it, I guess it’s up to us.” We’ve seen such equilibrium effects before in response to elections.

The value propositions emerging to meet these consumer demands are exceptional and have nothing to do with ideology or freezing in the dark to save the planet. Our portfolio companies are profitably supplying core, and often essential, services: water, food, electricity, mobility, health (both human and environmental), information utilities, heating/cooling, waste management ― and simply doing so in an updated, more environmentally aligned and “future-proofed” way. For example, EVs offer instant torque and astonishing pickup, and, paraphrasing Mark Twain, their death has been greatly exaggerated ― in fact, EV sales continued their double digit growth in 2024 and took more market share from traditional gasoline vehicles, whose sales actually declined. EVs offer a lower Total Cost of Ownership (TCO) than gasoline vehicles, once lower fuel and maintenance costs are factored in.

We have mostly avoided direct exposure to automakers as it has been hard to find durable competitive moats in this cutthroat, profit-challenged industry. Instead we own companies like Schneider Electric, which offers smart charging infrastructure for commercial fleets and residences, as well as Uber and Waymo (through Alphabet), which are making ownership of vehicles less essential by offering mobility as a service.12 They are also leading the accelerating move to electric and autonomous vehicles. Uber drivers are adopting EVs five times faster than the average motorist in the US, Canada, and Europe ― supporting Uber’s goal to become a zero-emissions platform by 2040. Waymo, which we’ve long assessed as an undervalued growth option in our sum-of-the-parts valuation of Alphabet, completed a funding round at a $45 billion valuation in October, and is rapidly expanding its autonomous ride-hailing services from San Francisco, Phoenix and Los Angeles to Austin, Atlanta and Miami ― and onward toward a likely sum of 10 cities in 2025.13

Even when sustainable value propositions are priced a bit higher, this is not always a deterrent: 80% of consumers said in PwC’s 2024 Survey that they are willing to pay up for them, on average about 10% more.14 This speaks to the pricing power criterion we look for in investment candidates, and found in Chipotle Mexican Grill, which we bought in the fourth quarter. While Chipotle offers famously good value for the dollar, its average customer ticket is higher than McDonald’s. Its loyal base of Chipotle Reward members has grown to 40 million and Chipotle has compounded net profit a remarkable 33% annually since 2021, even as it raised prices seven times (22% cumulatively) over that time. Their value proposition resonates: 51 recognizable, pronounceable, unfrozen, unadulterated and increasingly organic ingredients ― at a time when growing transparency expectations, adoption of GLP-1 weight loss drugs (Ozempic, Wegovy, Zepbound) and likely regulatory change (RFK Jr.) are trending against processed and fast food.15 We see ample runway for growth in Chipotle’s primarily company-owned (i.e., not franchised) store model in the US and abroad, and perpetuation of its sector-leading 26% return on invested capital, which we project will climb into the mid-30’s by the end of the decade.16

Another Layer of Policy Resilience: Investing in Adaptation

If, despite the points above, the world invests less in mitigating climate change today due to policy retreat, this just means, in our estimation, that we will need to invest proportionally more into steeper emissions reductions later. Humanity’s survival instincts will kick in as the alarm bells come to ring even more loudly and we find ourselves in catch-up mode, making solutions all the more dear...and rewarding to the long-term investors who saw it first. Another derivative is this: if we invest less in mitigation today, and more severe impacts ensue, adaptation solutions will also be more valuable.These are the must-have solutions, chronically underfunded so far, that will help humanity cope with what we failed to prevent ― and are part of our investment universe and portfolio. Examples include:

- Core & Main, which we bought in the second quarter, is the largest distributor of water infrastructure products, whose fastest growing segment is storm drainage as it serves a nation coping with more intense storms and floods. The National Association of Clean Water Agencies estimated that states will need to spend $448 to $944 billion dollars by 2050 to reengineer water systems to cope with sea level rise, extreme weather events, droughts, and floods. Core & Main is well positioned to capture a growing share of that spend as it rolls up and modernizes this essential, still fragmented, industry.17

- WillScot, also bought in the second quarter, is the market leader in modular working space and storage solutions that are used, for example, to set up temporary classrooms and reconstruction sites in the aftermath of major climate disasters like the Hawaii wildfires in 2023.18 More broadly, their diversified core business supports the building and renovation of nearly all economic sectors. Like United Rentals, WillScot is a beneficiary of the manufacturing re-shoring that could accelerate under Trump’s trade policies. And like both United Rentals and Uber, it is a leader in the sharing economy, refurbishing its units seven times over their useful life and redeploying them for the next customer. We believe that business models like these, which are rich in flexible/mobile assets, will become proportionally more valuable over time than fixed asset businesses such as real estate that are exposed to extreme weather and sea-level rise.

- Trane’s efficient air conditioning systems will become even more essential as we adapt to a hotter planet. Trane’s exceptional 53% total return in 2024 was underpinned by robust sales, order and earnings growth. Its backlog stands at $7.2 billion, of which 90% is “applied” systems featuring a long services tail whose estimated value is 8-10X the price of the initial sale. In 2025, the transition to higher priced, less heattrapping R454B refrigerant should support a high single digit pricing increase

- Thermo Fisher and Danaher: Our life sciences companies underperformed in 2024, with slightly negative returns, due to weak demand in China, a slowdown in biotech funding, and a lingering falloff from the growth surge during COVID. However, experts believe another health crisis, or even pandemic, could be brewing with H5N1 avian flu as infections are spreading among dairy cows and farmers.This phenomenon of zoonotic spillover (animal to human transmission, with risks for subsequent human-to-human transmission) is expected to accelerate due to a changing climate, and habitat encroachment. Thermo Fisher offers a PCR-based solution for detection of avian influenza.19 Danaher’s products support avian influenza research, surveillance, vaccine development, and public health preparedness.20 Both supply research labs with the tools to develop innovative vaccines and therapeutics for H5N1 avian flu and other emerging diseases.

New Buys for a Dynamic Future

Having refined our integrated fundamentals plus sustainability thesis on Amazon since buying it in 2021, we added two companies in the first quarter that are dominantly executing its playbook in non-U.S. markets: MercadoLibre, which also includes MercadoPago, a fast-growing payments segment servicing a vast, underbanked Latin American population, and Coupang, which is advancing robotic logistics to power its Rocket Delivery (99.6% of orders delivered within 24 hours) and delighting customers, including the two-thirds of South Koreans who are now WOW subscribers (their Prime equivalent).21

In late June, we bought Core & Main, Verisk (discussed in our third quarter letter, viewable here) and Synopsys, a leader in the Electronic Design Automation tools and IP used by Nvidia, Broadcom, Google and others to design and test AI chips and other semiconductors. Synopsys is on track to complete its acquisition of Ansys, the leader in engineering simulation software that enables innovators to design, test, and optimize products and processes virtually before physical prototyping ― a crucial tool for redesigning and renovating the world. This, in combination with our second quarter buy of Nvidia, rounds out our full-value-chain embrace of AI, which we believe offers revolutionary potential across sectors, including optimization of resource use and materials science innovations that will extend the sustainability frontier, though its energy burden must be well managed.22 One driver of our purchase was Nvidia’s decision to move to an annual cadence new product releases, signifying the opposite of complacency, backed up by its expected doubling of R&D spending from $6 billion in 2023 to $13 billion in 2025.23 These investments should further widen its moat in advanced AI chips and software, while powering its move into disruptive segments like humanoid robots (Nvidia’s Jetson Thor robot tech stack is expected to launch this year).24 Our portfolio features a higher allocation to R&D as a percentage of sales than the S&P 500, and this is by careful design on our part. It reinforces that sustainable investing is, at its core, about selecting companies we deem best positioned to skate to where the puck is going. Studying the investment implications of environmental challenges hones our skills for this kind of calculated futurism, and its application to non-environmental, secular trends.

Just before the U.S. election, we sold NextEra Energy, which had already turned in a strong year-to-date return, and bought Constellation Energy. We had been studying Constellation for a year, believing its supply of baseload electricity from the largest nuclear fleet in the country would be even more highly valued as the country grappled with a looming power shortage due to the AI datacenter buildout, EV’s share gains and the secular electrification trend. In September, Microsoft announced a 20-year deal with Constellation to buy premium-priced power from reopening of a Three Mile Island reactor.25 As a merchant power supplier rather than a regulated utility, Constellation is positioned to win more such premium deals, skewing its risk-reward to the upside in our estimation. Anticipating a potential Trump victory, we also believed that nuclear incentives in Biden’s climate law were more likely to survive than those for renewables given nuclear’s status as a bipartisan, carbon-free power source. As usual, our base case thesis did not depend on this outcome, but we factored various policy scenarios into our bull and bear cases. Just today, Constellation secured a landmark deal with the U.S. General Services Administration for two major contracts supplying $1 billion of power over 10 years to 80 federal facilities. It also includes a $172 million Energy Savings Performance Contract to install LED lighting, HVAC upgrades, and convert steam to electric heating.26

Performance

Our 14.71% gross / 13.79% net return in 2024 is in line with our 8-year annualized return (16.00% gross / 14.96% net). Our 35% non-US holdings turned out to be a headwind to relative performance, at least over the short term, as Trump’s win strengthened the dollar and weighed on our ADRs. Our sales later in 2024 reduced our non-US exposure to 27%, a modest concession to trade war risks ahead. Based on prevailing valuations, we continue to believe in preserving a significant non-U.S. allocation at this time. Our portfolio return was just ahead of the equal weighted index, which delivered a total return of 13%. The median stock was up 11% in 2024, speaking to the narrowness of this year’s index return. Our portfolio companies generated 28.6% in earnings growth over the last 12 months, while the Price-to-Earnings multiple (P/E) they command in the market contracted -7.0%. For comparison, the companies in the S&P 500 generated admirable but considerably slower earnings growth of 9.6%, but benefitted from 13.7% expansion in their P/E multiple. Equity returns tend toward earnings growth (plus dividends) over time, so we believe our companies’ demonstrated earnings power and the lack of reliance on multiple expansion to produce this year’s return bode well looking forward. See performance below:

If you missed our last Impact Report, issued in May, you can read it here. Thank you, as always, for entrusting us with your capital, and please be in touch if you’d like to set up a call.

Sincere regards,

The Douglass Winthrop Team

Please see endnotes below and important disclosures at the end of this document.

- https://www.economist.com/weeklyedition/2024-10-19

- The Magnificent 7 refers to the largest market cap weighted constituents of the S&P 500, whose total market cap exceeds $18 trillion (over 30% of the S&P 500) and whose returns have led the market in 2023 and 2024. They include: Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta Platforms and Tesla. In the Sustainable Equity Strategy, we owned Microsoft, Alphabet and Amazon entering 2024, and added NVIDIA in Q3 – meaning we own 4 of the 7, albeit in different weights than the S&P 500 index. The market broadening began in mid-2024 and accelerated after the September rate cut. A midyear sector rotation and overall market broadening in 2024 reduced the return contribution of the top-seven S&P 500 stocks from 60% in the first half to 23% in the second half through November. See: https://www.blackrock.com/us/individual/insights/taking-stock-quarterly-outlook

- Though this thinness in the yield investors demand from corporate bonds relative to Treasuries may have partly reflected the less pristine quality of Treasuries as the debt-to-GDP ratio grew to World War II levels and interest payments on the debt surpassed military spending for the first time, leaving a fraught debt ceiling debate looming over the incoming Congress and the country’s debt rating. See a Barron’s columnist comment on U.S. debt and the risk that Moody’s follows S&P and Fitch in a downgrade this year, see: https://www.barrons.com/articles/debt-doom-u-s-triple-a-credit-rating-22cacf99?mod=Searchresults

- On affordability concerns, a Bank of America Institute study indicated 26% of US households use 95% of their net pay to cover essential expenses such as housing, utilities, insurance and groceries. However, a higher 47% “believe” they are living paycheck to paycheck, a more subjective measure. See: https://www.usatoday.com/story/money/2024/12/05/living-paycheck-to-paycheck-debt/76733415007/ and https://retailwire.com/americans-livingpaycheck-to-paycheck-increasing/

- On the affordability crisis boosting Trump, see: https://apnews.com/article/economy-trump-inflation-prices-election-tariffs-immigrantse791d15158195a8a15a71ee43c77d749 and specifically on housing affordability, see: https://finance.yahoo.com/news/housing-market-affordabilitycrisis-gave-222722620.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cucGVycGxleGl0eS5haS8&guce_referrer_sig=AQAAANIKtU2p3tnDqFpbMX_1QH1W JNGDQOixGR4_sJcYHGTzQYsDAOhbjQDTTtqtGqsRotzmoWEmNEbp9IvsMJvIVGcQiP0CjYxAq7BqAnVoym7p- L8nPxk9ZxzzixU4YKc_BlMrAHZ7qR9IA6BgpjYlmjIfyKvB5zQ6mW9pU3bP_zgd. On the widening wealth disparity, note that the top 10% of households held 67% of total household wealth, while the bottom 50% held only 2.5%. See: https://www.counterpunch.org/2024/11/20/inequality-the-missing-wordin-the-2024-election/.

- On climate being a non-issue in the 2024 campaign, see: https://sustainability.yale.edu/explainers/yale-experts-explain-politics-climate-change and https://www.euronews.com/green/2024/11/01/climate-change-was-a-major-us-election-issue-in-2020-why-has-it-taken-a-back-seat-in-2024. On 2024 heat, see: https://www.carbonbrief.org/state-of-the-climate-2024-now-very-likely-to-be-warmest-year-on-record/. On the 24 disasters over $1 billion each, see: https://abcnews.go.com/US/billion-dollar-disasters-2024-analyzing-matters/story?id=116832379. On one-third of the U.S. being in drought, see: https://www.ncei.noaa.gov/news/us-drought-weekly-report-december-17-2024. On the Park Fire: https://www.cbsnews.com/news/california-parkfire-map-animation-one-of-the-largest-in-state-history/ and https://www.latimes.com/california/story/2024-07-27/how-park-fire-largest-california-chico

- https://www.climate.gov/news-features/event-tracker/multi-year-drought-and-heat-waves-across-mexico-2024. On Central American drought and emigration, see: https://lbj.utexas.edu/unusually-dry-growing-seasons-central-america-associated-migration-us

- On coffee prices being at a 50-year high, see: https://www.cnbc.com/2024/12/13/coffee-prices-analysts-warn-it-may-take-years-for-the-rally-tofade.html. Cocoa prices reached a record high in December 2024, with futures briefly hitting $12,906 per metric ton on the international exchange. This represents an unprecedented surge of approximately 172% over the course of 2024. The dramatic increase in cocoa prices is primarily attributed to adverse weather conditions and crop failures in major producing countries like Ghana and Ivory Coast, leading to the largest global cocoa supply deficit in over 60 years. See: https://www.marketwatch.com/story/cocoas-the-best-performing-commodity-in-2024-and-even-beat-bitcoin-whats-next-b8daf55d. Olive oil prices reached a record high in January 2024, with extra virgin olive oil in Spain's Andalusia region hitting €9.2 per kilogram. This unprecedented price surge was primarily driven by severe droughts and extreme weather events in southern Europe, which significantly reduced olive yields in major producing countries. See: https://www.cnbc.com/2024/11/15/spains-deoleo-says-olive-oil-prices-set-to-halve-from-record-levels.html. On climate change accelerating the H5N1 avian flu spread and evolution, see: https://theconversation.com/climate-change-is-helping-the-h5n1-bird-flu-virusspread-and-evolve-230361 and on extreme heat reducing compliance with protective equipment, increasing avian flu exposure, see: https://ft.com/content/125e89c0-308a-492f-ae8e-6834847d1186 https://www.theguardian.com/world/article/2024/jul/19/extreme-heat-human-bird-flu. There is a growing debate over whether central bankers should continue to exclude volatile food prices from “core” inflation measures, given that climate change is causing sustained inflationary pressure, see: https://www.ft.com/content/125e89c0-308a-492f-ae8e-6834847d1186

- The Douglass Winthrop Sustainable Equity Strategy was in the top 2nd percentile on a gross basis and top 3rd percentile on a net of fees basis relative to 868 Global ESG peers for its 7.75 years since inception (through September 30, 2024). Figures through end of 2024 are not yet available.

- Nearly 60% of the announced clean energy and vehicle projects, representing 85% of the investments and 68% of the jobs, are located in Republican congressional districts. See: https://e2.org/releases/new-report-334-major-clean-energy-clean-vehicle-projects-announced-in-first-two-years-of-ira-126bin-investments-109k-jobs-across-40-states/ and https://e2.org/reports/clean-economy-works-two-year-review-2024/. In August 2024, 18 House members sent a letter to House Speaker Mike Johnson asking him to preserve industry tax credits if the party is successful in November. See text of the letter here: https://garbarino.house.gov/sites/evo-subsites/garbarino.house.gov/files/evo-mediadocument/FINAL%20Credits%20Letter%202024.08.06.pdf

- One in three U.S. adults have been personally affected by extreme weather. See: https://news.gallup.com/poll/391508/extreme-weather-affected-onethree-americans.aspx

- See https://www.se.com/sg/en/work/solutions/for-business/automotive-and-emobility/emobility.jsp and https://blog.se.com/sustainability/2024/07/05/schneider-electric-is-scaling-its-emobility-solutions-today-for-a-greener-singapore/

- Waymo bulls estimate a valuation above $300 billion, which is close to our internal bull case. See: https://www.barrons.com/articles/buy-googlealphabet-stock-price-ai-doj-break-up-calls-3ea5d918?mod=hp_STOCKPICKS_5

- https://www.pwc.com/gx/en/news-room/press-releases/2024/pwc-2024-voice-of-consumersurvey.html#:~:text=More%20than%20four%2Dfifths%20(80,sustainable%20produced%20or%20sourced%20goods. On climate change spiking the price of olive oil: https://phys.org/news/2024-06-stress-olive-oil-climate.html.

- Robert F. Kennedy, Jr. is nominated but not confirmed yet as Trump’s nominee for Secretary of Health and Human Services. Even if not confirmed, he is expected to be an influential White House advisor. He has indicated plans to revise dietary guidelines to address ultra-processed foods, reform federal programs that subsidize them and impose stricter regulations on food companies. His plans are expected to face fierce pushback by industry lobbyists and certain elected officials, though there is generally considered to be bipartisan support for food policy reform (not for his vaccine policies). See: https://www.npr.org/sections/shots-health-news/2024/11/15/nx-s1-5191947/trump-rfk-health-hhs and https://time.com/7200323/rfk-jr-hhs-foodnutrition-health/

- The Return on Capital Invested equation is calculated inclusive of operating leases. Chipotle has struck a franchising deal for the Middle East only, and intends to continue growing with a company-owned model in the U.S., Canada and Western Europe. See: https://www.restaurantbusinessonline.com/operations/chipotle-takes-first-ever-international-franchise-partner

- https://www.bluegreenalliance.org/resources/wonk-wednesday-jumping-into-water-infrastructure/

- https://www.linkedin.com/posts/willscot_a-place-for-healing-temporary-king-kamehameha-activity-7182012889233338368-mJBK?utm_source=share&utm_medium=member_desktop

- https://www.thermofisher.com/us/en/home/industrial/animal-health/vetmax-gold-usda-licensed-solutions/avian-influenza-virus-detection-kit.html and https://www.businesswire.com/news/home/20240610629392/en/Integrated-DNA-Technologies-Announces-New-Primers-and-Probe-Set-to-Identify-H5N1-Avian-Influenza

- https://www.technologynetworks.com/analysis/product-news/integrated-dna-technologies-announces-new-primers-and-probe-set-to-identify-h5n1-avian-influenza-387901

- https://www.roboticsandautomationmagazine.co.uk/video/coupang-unveils-one-of-asias-largest-highly-automated-fulfilment-centres-in-korea.html and https://koreajoongangdaily.joins.com/2023/02/07/business/industry/Coupang-Daegu-FC/20230207080005753.html

- https://www.economist.com/by-invitation/2024/06/17/ray-kurzweil-on-how-ai-will-transform-the-physicalworld?utm_content=section_content&gad_source=1&gclid=Cj0KCQiAj9m7BhD1ARIsANsIIvCS9aCrKKBJGK8YOXOU_jg2s60PooDjGJ6jCzEQ1acdPEpheKMuTwaAswdEALw_ wcB&gclsrc=aw.ds and https://www.weforum.org/stories/2024/09/ai-accelerator-sustainability-silverbullet- sdim/ and https://www.ey.com/en_nl/insights/climate-change-sustainability-services/ai-and-sustainability-opportunities-challenges-and-impact

- The R&D projection is from Factset consensus estimates. The Nvidia announcement of an annual cadence for new product releases is from the First Quarter 2024 Nvidia Earnings Call in May 2024.

- https://iottechnews.com/news/nvidia-fuel-humanoid-robots-jetson-thor/ and https://www.yahoo.com/news/nvidia-wields-jetson-thor-hammer-140611430.html

- https://www.stocktitan.net/news/CEG/constellation-wins-record-setting-federal-government-clean-nuclear-35mrjeihuh8e.html