July 7, 2024

Dear Sustainable Equity Strategy Clients and Friends:

Tailwinds are a metaphor commonly used by investors to describe external, usually temporary, reinforcers of their core investment thesis, but on a recent Sunday I am benefiting from the real thing. Midway through my crosscountry flight, the pilot happily announces that we will land 25 minutes early. The expediting tailwinds have added enough turbulence that the flight attendants are unable to safely perform a standard drink service, but thirst is a small price to pay for the found time. On arrival, however, the pilot announces that we’re so early that there is no gate open to pull into and we will need to wait on the tarmac for — you guessed it — about 20-25 minutes. The moral of my prosaic flight story: tailwinds can be valuable, but should never be mistaken for the whole story, even when they dominate cheery pilot announcements or exuberant financial headlines.

Let’s torture the metaphor a bit. You need a sturdy aircraft to power the journey and withstand inevitable turbulence ― in investing, we might think of this as the fundamental quality of the company. You need a runway landing slot and an open gate, which we might relate to a company’s product / market fit and customer acceptance ― neither of which can be assumed at any given moment in congested airports or competitive markets, respectively. As for the tailwinds, the real-life version can weaken or even turn into crosswinds or headwinds at different altitudes based on local weather systems or seasonality, even in defiance of the persistent west-to-east jet streams. The same applies to investing tailwinds, such as falling interest rates or supportive policy, which can weaken or reverse situationally based on Fed decisions or elections, even in defiance of long-term secular trends.

With half of the global population voting in elections in 2024, some clients have asked whether government policies could reverse from tailwinds propelling our companies to outright headwinds.1 The rightward shift in the European Parliamentary elections in early June, including the loss of Green Party representation, is expected to weaken support for the EU Green Deal, which we’re monitoring for potential impacts on our EU-domiciled holdings though all of them sell into globally diversified end markets. The National Rally was denied victory in France after a strong first-round showing, reducing risks that the country will backslide on environmental policy. Labor’s victory in the UK is expected to strengthen its net zero policies. Here in the U.S., where approximately 65% of our current holdings by weight are domiciled, the Presidential election has injected uncertainty into the near future of environmental policy, including potential reversal of climate provisions in the Inflation Reduction Act. It’s worth noting that during the four years of the deregulatory Trump Administration, which featured withdrawal from the Paris Agreement, our Strategy returned an annualized 24.8% gross (23.8% annualized net of fees), compared to the S&P 500’s return of 16.0% and MSCI World’s return of 13.4% over the same period – a substantial outperformance that speaks to our portfolio’s resilience but also to the fact that many other factors beyond policy tend to drive the intrinsic and market value of companies.2

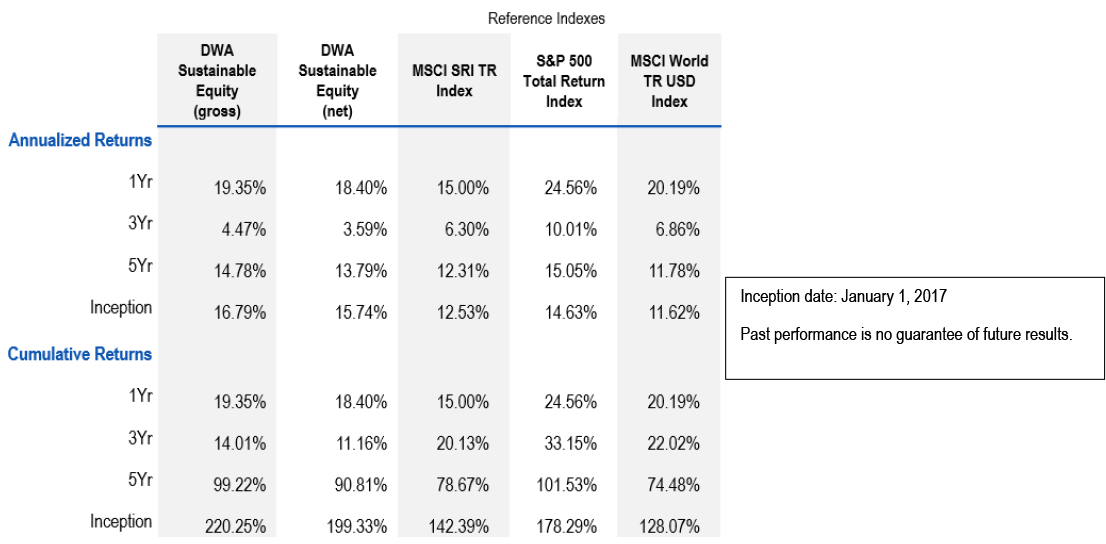

But here's the key point: by careful design, and as the evidence above suggests, our investments do not depend on the tailwinds of supportive policy but rather on our assessment of the fundamentals of each company (i.e., the jet) as well as its ability to navigate secular trends (i.e., the jet streams underlying short-term turbulence and variable tailwinds / headwinds). We will discuss each in this letter. But first we report that the Strategy returned 12.09% gross / 11.64% net of fees in the first half of 2024. More relevantly, given our long-term horizon, our annualized return over the 7.5 years since inception is 16.79% gross /15.74% net of fees, ahead of our reference indexes. See page five for the performance table. (Past performance is no guarantee of future results.)

Fundamentals First: The Quality of the Jet

We are fundamental investors first. This means we select high-quality, conservatively capitalized businesses that command dominant and typically growing shares of their markets due to competitively advantaged products and services, and enduring business models. Our companies tend to have higher revenue and Earnings Per Share (EPS) growth rates than the S&P 500, in part because they are selling solutions to the world’s intensifying challenges or capturing other material E-Advantages. Our holdings have favorably lower debt leverage, on average, than the S&P 500, enhancing their financial resilience through economic cycles. Their revenues tend to feature a significant recurring portion, boosting earnings consistency. Many are entrenched in their customers’ lives and enterprises through network effects, integration into workflows or by meeting essential needs (energy, food, water, waste management, etc.). All are selected for their compelling opportunities to reinvest profitably in further growth.

Our companies’ average market share is 43% of their primary revenue segment, with 2/3rds having greater than 30% market share. Six have a share above 80%,3 endowing them with rare pricing power, profit margins and cash flow to reinvest in sustaining their dominance and extending it to select adjacencies. Several other holdings have lower absolute market shares, but still the largest in fragmented industries they are adeptly rolling up. Our research focuses on competitive dynamics: 75% of our companies hold the #1 market share, while 91% hold the #1 or #2 position, in their primary segments. And speaking of jets, we own Airbus, a leader in advancing the lightweighting, efficiency and low carbon fueling of aircraft, which has surged to a 62% share of the narrowbody aircraft market, due in part to Boeing’s unfortunate stumbles.

The Jet Streams: Secular Trends and Long-Horizon Investing

Putting our metaphor back on the torture rack to stretch, note that there are four primary jet streams – a polar and sub-tropical stream in both the Northern and Southern Hemispheres, each of which can branch and join again, creating swirling eddies along the way. Like jet streams, primary secular environmental trends such as climate change, water stress, agricultural degradation, ecosystem impairment and biodiversity loss also branch into many sub-trends — of a policy and non-policy nature. Climate change has driven increasing, if belated, policy stringency as the seriousness of the problem has become more tangible and severe.4 But elections and resulting policy outcomes often turn on many other issues: as referenced above, post-COVID inflation and the “affordability” crisis have contributed to populist advances in Europe that imperil the policy progression to address climate. But such electoral reversals cannot stop the non-policy sub-trends that also emanate from the same underlying secular trends, such as: physical climate impacts; rising public concern with droughts, floods, wildfires, and microplastics pollution (which, in turn, sometimes lead consumers to incorporate sustainability into their purchasing criteria); and the momentum of technology innovation. To paraphrase Jeff Goldblum’s comment on the irrepressibility of life in Jurassic Park, secular trends “will find a way.”

Plus, many sustainable products and services simply offer superior economics because of their energy and resource efficiency, or their winning customer value propositions that have absolutely nothing to do with policy subsidies, such as: greater convenience, lower total cost of ownership, reduced health risks and so on. Here is an illustrative selection of secular trends that we factor into our investment process, some more directly rooted in fastmoving environmental objectives like decarbonization, and others accelerating based primarily on nonenvironmental secular drivers but also interconnected in fascinating ways to meeting environmental challenges.

- The Inevitability of Clean Electrification: Electricity is the most versatile, efficient, high-quality energy carrier we have, especially when generated by renewables. We believe its continuing march to displace fossil fuels and outcompete overhyped alternatives like hydrogen is inevitable based on first-principle physics and the favorable economics that ensue.5 Electricity’s superior value proposition is clear not just in its amenability to clean, low-carbon generation at the front end, but in nearly all its end uses: electric vehicles (instant torque / “insane” pickup, lower total cost of ownership); induction stoves (faster heat transfer than gas ranges without the indoor pollution and asthma risk); reversible heat pumps (up to 300% efficiency — that’s not a typo — since it moves existing heat to warm and cool spaces, rather than needing to generate all of it); electric lawn mowers and leaf blowers (no noise or local air pollution); and electrification of industrial processes such as electric arc furnaces for steel-making. Portfolio exposures: Brookfield Asset Management, NextEra Energy, Siemens, Schneider Electric, Uber (Uber Green)

- Artificial Intelligence’s Sustainability Leverage: Beyond its revolutionary semantic intelligence for consumer applications, the sustainability benefits of AI promise to be transformational across nearly all verticals – enabling breakthrough designs (recall our Q3-2023 letter on AI-powered biomimicry) and precise optimization of resource use in real-time. AI gives us a fighting chance to bring non-linear leaps in ingenuity to counter the non-linear threats of ecosystem collapse presented by climate change. Our exposures here are two of our four top year-to-date performance contributors: ASML and Taiwan Semiconductor, for whom ~6% of revenue came from AI chips in 2023, but which we expect to rise to 20+% of revenue by 2028 as it continues to be the indispensable chip manufacturer for Nvidia, AMD and the large cloud AI providers we own that have also surged, Microsoft, Alphabet and Amazon. Industrial holdings like Siemens are poised to be beneficiaries of AI’s next wave, partnering with Nvidia to boost industrial productivity through digital twins.6

- E-Commerce’s Unbeatable Value Proposition and E-Friendly Scaling: While its growth rate has slowed, ecommerce will, we believe, continue to steadily gain share of overall retail sales based on its superior value proposition (i.e., massive catalogues to choose from with delivery converging from next-day to same-day to even faster). We believe its significant and growing environmental advantages will accelerate this uptake as climate concerns grow. E-commerce offers up to an estimated 50% reduction in end-to-end greenhouse gas emissions relative to brick-and-mortar retail (no stores to light or heat, fewer customer trip- miles, electrification and route optimization of last-mile delivery fleets).7 As e-commerce densifies its footprint with more users, more can be delivered in one box and on one trip down a neighborhood street. Boxes are lighter and even being eliminated. Exposures: We have leaned into this trend, adding Coupang (dominant in South Korea) and MercadoLibre (dominant across Latin America) in 2024 to our Amazon holding, which has been our 6th highest year-to-date performance contributor and is poised, we believe, for accelerating free cash flow generation.8

- Keeping People and Food Cool in a Heating World: We are unfortunately on track for 2024 to break 2023’s record as the hottest year in the instrumental record. April 2024 was the 11th consecutive month of unprecedented global temperatures and global sea surface temperatures have been at record highs for 13 consecutive months.9 Please forgive one final turn on our metaphor, and this one will require some concentration (more than the Sports section but less than the crossword): climate change is now altering the polar jet stream in the Northern Hemisphere in ways that extend the duration of heatwaves such as we’ve been experiencing across the U.S. lately. The Arctic is warming faster than other latitudes, reducing the temperature difference between the poles and the equator and weakening the polar jet stream, allowing it to meander and set up an Omega blocking pattern that entrenches dangerous heatwaves. As such, one of the investable offshoots of our secular climate trend is the increasing need for efficient space cooling and refrigerated trucking to move food and medicine. In a sense, our real-life jetstream has merged into our metaphorical one. Exposures: Trane and Carrier, the former our third highest year-to-date contributor and the latter a position we boosted in size this year as it completed a successful portfolio transformation and saw rapid growth in its datacenter cooling addressable market and backlog, driven significantly by the AI buildout.

We study and invest into many other secular sustainability trends, from the sharing economy to climate-resilient infrastructure renovation to circularity solutions that avoid plastics. All are in their early innings, making them integral to our long-horizon investing philosophy. We certainly hope that humanity will succeed in mitigating negative secular trends such as an overheating world, while seizing the positive, life-enhancing value propositions we’ve touched on above. Investing in companies offering solutions or enhanced resiliency does not mean avoiding the systemic risks that climate change poses to global wealth — that is impossible. But it does offer, we believe, the prospect of attractive, above-market risk-adjusted returns as well as a way for impact-oriented investors to align their capital with their aspirations for a better world. An estimated $150 trillion needs to be spent by 2050 to finance the transition to a low-carbon economy, making this one of the biggest investment opportunities of our — or any — generation.

Performance

We appear to be in a somewhat benign macro environment in the U.S., with low unemployment, solid wage growth, relatively healthy consumer and corporate balance sheets, and moderate though still elevated inflation (the last monthly core inflation reading was 3.4%). All this supports the mid-2% GDP growth expectations we’re hearing from economists for the year, and a plausible rate cut in the balance of 2024. This Goldilocks environment must nonetheless contend with the continuing risk of war escalations, election year uncertainty and a highly valued U.S. equity market that could persist and broaden beyond its narrow tech outperformers or pull back in a rush to safety. We believe this backdrop reinforces the value of somewhat more diversification into non-U.S. holdings, as we’ve done in recent years, and of allocating to active equity strategies like ours that strive to look through the headline turbulence and variable headwinds / tailwinds to focus on owning quality companies poised to benefit from longterm secular trends. Finally, please note that we sold longtime holdings Autodesk and Trimble in Q2, both of which were unable to complete their regulatory filings on time, creating new black box risks that we could not responsibly underwrite on your behalf.10 We also parted with Nike on the last trading day of the quarter, after having trimmed it earlier in 2024.11 Performance is below.

Thank you, as always, for entrusting us to steward your capital. If you’d like to set up a call, please be in touch with either Dan Abbasi at dan@douglasswinthrop.com or Bowdy Train at bowdy@douglasswinthrop.com.

Best regards,

The Douglass Winthrop Team

- https://www.npr.org/2024/06/30/g-s1-6338/2024-major-elections-npr-reporting

- Please note that the cited performance figures are from January 1, 2017 to January 1, 2021, not inauguration day to inauguration day precisely.

- Uber with 80% of U.S. rideshare bookings, Taiwan Semiconductor with 80% of advanced node semiconductor manufacturing; Intuit with 84% of small and medium business accounting software in the U.S., ASML with 95% of advanced lithography machines enabling advanced chipmaking, Alphabet with 90% of global search and a new Q2 buy with 90% share of its market. Inception date: January 1, 2017. Past performance is no guarantee of future results.

- This usage of the term “secular” derives from the Latin word "saeculum," which means "age" or "century", emphasizing the long-term nature of these trends, typically spanning decades or even centuries and transcending short-term fluctuations or cycles, such as electoral or interest rate cycles. It originated in astronomy during the 18th century. Astronomers adopted the term to describe long-term, non-periodic variations in celestial motions. Earth sciences borrowed the term to describe long-term geological changes. Economics adopted it in the 19th century to describe long-term economic trends.

- Electrical energy has more exergy (available energy to do useful work) compared to heat energy from fossil fuels. Electricity can be converted to useful work with much higher efficiency than fossil fuels. While fossil fuels like gasoline typically have conversion efficiencies of 20-40% in internal combustion engines, electrical energy can be converted to mechanical work with efficiencies over 90% in electric motors. Electrical energy can be easily converted into various other forms of energy (mechanical, light, heat) with minimal losses. This versatility makes it a more "useful" form of energy compared to the chemical energy stored in fossil fuels. When burning fossil fuels, a significant portion of the energy is lost as heat due to the limitations of the Carnot cycle. Electrical energy doesn't have this inherent thermodynamic limitation, allowing for potentially higher efficiencies in energy utilization. Electricity is considered a higher quality energy source because it can be easily controlled, transported, and converted into other forms of energy with minimal losses. While electricity itself can be considered a lower entropy form of energy, the method of electricity generation can impact its overall environmental footprint. Electricity generated from renewable sources like solar or wind has a lower entropy impact than electricity generated from burning fossil fuels in power plants.

- A digital twin is a virtual representation or digital counterpart of a physical object, system, or process. Siemens is at the forefront of developing and implementing digital twin technology across various industries. Digital twins are created using real-time data, simulation, and modeling techniques to mirror the behavior, characteristics, and performance of their physical counterparts. They integrate all data, simulation models, and other information from a physical object generated during engineering, commissioning, operation, and throughout its lifecycle. Siemens utilizes digital twins for several purposes: optimization and predictive maintenance; lifecycle management, providing virtual environments for testing and analysis. Siemens is also working on enhancing digital twins with immersive, interactive, and collaborative features, moving towards what they call the "Industrial Metaverse". Siemens partnership with Nvidia combines Siemens' Xcelerator open digital business platform with NVIDIA's Omniverse, an AI-enabled virtual world engine, allowing for comprehensive digital twins with real-time performance data. See: https://blogs.sw.siemens.com/xcelerator/2023/10/11/siemensxcelerator-and-nvidia-omniverse-enable-the-industrial-metaverse/. The collaboration is expanding to include generative AI for immersive real-time visualization, which will help in creating more sophisticated digital twins and improving industrial processes. See: https://press.siemens.com/global/en/pressrelease/siemens-and-nvidia-expand-collaboration-generative-ai-immersive-real-time

- https://publishing.gs.com/content/research/en/reports/2021/04/29/e966a25a-e0d3-490a-a910-bbc221cf8749.html

- Amazon took an astonishing 61% of incremental share of US retail sales (ex-fuel / autos) in Q1 2024. Its regionalization efforts have lowered Amazon’s cost to serve in the US by $0.45 per unit year-over-year (the first time it has lowered its year-over-year cost to serve since 2018). In 2023, Amazon delivered 7 billion items on the same or next day across the globe – driving our density of route thesis. Its scale enables it to offer a value proposition based on shared infrastructure that smaller players cannot rival. JP Morgan estimates the annual value of Amazon Prime is >$1,300 vs. the cost of Amazon Prime of $139 – this represents a >9x multiple of Prime value to cost. Amazon continues its strategic push into regionalized distribution sites and away from its original centralized approach. As of 2023, Amazon’s Air network saw a 17% drop in average miles traveled per flight from its 2019 peak. Similarly, over 50% of flights in 2023 were less than 1,000 miles vs. just 23% in 2021. CEO Andy Jassy said: “One example of this is our work to increase the consolidation of units into fewer boxes. As we further optimize our network, we've seen an increase in the number of units delivered per box, an important driver for reducing our costs. When we're able to consolidate more units into a box, it results in fewer boxes and deliveries, a better customer experience, reduces our cost to serve and lowers our carbon impact.”

Coupang delivered Q1 ’24 revenue growth of 23% y/y while South Korean retail sales grew just 2% y/y, meaning Coupang continues to take market share. Coupang is becoming a utility in South Korea with growing pricing power. In April, Coupang announced it would raise its WOW membership fee 58% from $3.59 to $5.67 per month. Coupang also reported strong Q1 2024 WOW member adoption where nearly 58% of the South Korean working age population are active customers, but only 29% of the South Korean population >16 years are WOW members which represents a longer ramp ahead than most had previously expected. 85% of Coupang orders do not use a box, reducing the waste and emissions associated with packaging. Coupang also introduced a closed loop reusable fresh bag / polyethylene ice pack for grocery delivery that is cleaned/sterilized and reused. MercadoLibre continues to gain share in Brazil from the bankruptcy of competitor Americanas. Our internal estimates project that the company will have picked up 300 bps of market share over the past 12 months (See: https://www.ibge.gov.br/en/ibge-search.html?searchphrase=all&searchword=retail) The company rolled out its “Delivery Day” slow shipment option early last year and has seen a sharp uptick in users opting for this pre-scheduled delivery which is higher margin for the company and better for the environment. Slow-shipment penetration has increased from 0.2% in the first quarter of 2023 to 5.2% in the first quarter of 2024 (See: https://investor.mercadolibre.com/results/results-financials/ ) MercadoLibre has reached 1,000 electric vehicles (mix of vans/motorcycles) and installed over 200 charging points across LatAm (See: https://sustentabilidadmercadolibre.com/en/blog/mercadolibre-increases-its-electric-fleet-in-latin-america) - https://www.carbonbrief.org/state-of-the-climate-2024-off-to-a-record-warm-start/

- On April 1, Autodesk disclosed that it was conducting an internal investigation into its accounting practices, specifically regarding free cash flow and non-GAAP operating margin practices and was unable to file its annual report (Form 10-K) for the year ended January 31, 2024 on time. While this was concerning, Autodesk was a high conviction holding based on our long-term thesis and we maintained the position. On April 17, Autodesk indicated that the internal investigation was still ongoing, and it would not be able to to file its Form 10-K within the 15-day extension period, triggering our sale of the position.

On February 26, Trimble filed its 2023 Annual Report, stating that the company's internal control over financial reporting as of December 29, 2023, was effective. Then in mid April 2024, Trimble's auditors, EY, inform the company that their 2023 audit of Trimble was selected as part of the PCAOB's inspection of EY's work. During preparation for the PCAOB review, EY concluded that neither EY nor Trimble had sufficient documentation related to certain IT and other controls for revenue-related systems and processes and at the end of April, EY changed their conclusion regarding Trimble's controls over revenue, which they had previously deemed effective at the time of the 10-K filing. This led Trimble to announce on May 3 that its 10-Q filing will be delayed, that its 10-K will need to be amended to revise the internal control disclosures after EY completes additional audit procedures and the Annual Shareholders Meeting will be delayed until EY has completed their work. This prompted us to sell. - Nike has made continued advances on sustainable materials, renewable sourcing and carbon reduction, but has been reporting declining sales and margins due to rising competitive intensity, continued struggles in its crucial China market, and its failed pivot from wholesale to direct-to-consumer distribution, which had been a key element of our fundamental investment thesis. We sold Nike at the end of Q2 to reallocate capital to better opportunities.

Important Disclosures:

This communication contains the opinions of Douglass Winthrop Advisors, LLC about the securities, investments and/or economic subjects discussed as of the date set forth herein. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. The Sustainable Equity Composite (formerly DWA Environment Strategy) contains all discretionary accounts that are managed according to the DWA Sustainable Equity Strategy. Past performance does not guarantee future results. Gross and Net Performance: Gross returns are calculated gross of management fees and net of transaction costs. Net returns are calculated net of management fees. Fees for accounts in a composite may differ at the firm’s sole discretion from the stated fee schedule for new accounts. Performance is calculated on an asset weighted, time weighted return basis. Valuations and performance are reported in U.S. dollars. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENTS BEAR RISK INCLUDING THE POSSIBLE LOSS OF INVESTED PRINCIPAL.